This site, and many others recommend buying "the market", i.e. Total Stock Market funds(TSM), like FZROX/FSKAX or VTI.

Why can't we just pick the winners? Because it's nearly impossible to do consistently over long periods of time.

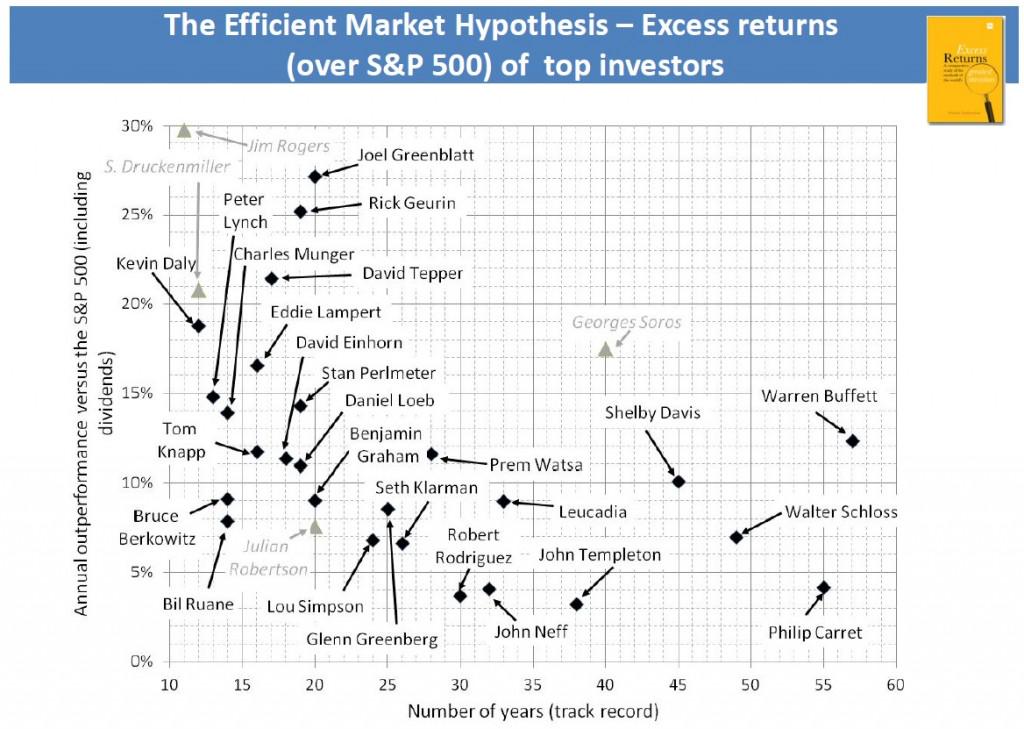

If you look at this picture, from "Excess Returns: A comparative study of the methods of the world's greatest investors"

We can see that over 40+ years, there is but 5. Chances are there are a few private investors also in that bracket, but take in that there are over 8 billion people on the planet, and we have a handful of investors known to have beaten the market over a very long time frame. This doesn't bode well for most of us to beat the market. That said, if you want to take 1-2% of your net worth and try to beat the market, go for it. But I'd only start doing that after you are pretty well settled with your financial future, so it doesn't matter if you lose it all; which is the most likely outcome.

You might be asking, well there are a bunch that managed over shorter time periods, I'll just do it for a few years. I agree, but stop to think about how long you are investing for? You are investing for your entire retirement + all the time you spend accumulating. So most of us start 401k's in their 20's or 30's. Average life expectancy is age 80. so 80 - 30 = 50 years. 60 years if you started investing in your 20's. The above graphic has 2 people that have managed to beat the market that long.

If you are going to be investing for half a century, then perhaps getting market returns isn't so bad after all. Plus once we pass on our money goes to our heir(s) and we want their financial future to be bright and shiny as well. So the $100 you are putting into a TSM fund today might stay in the market for 100 years!

The most famous beat the market guy, Warren Buffet does not recommend trying to beat the market, he recommends buying a broad, cheap index fund.

TODO: integrate RiskVsReward also.